Marketing Compliance in the Finance Industry: Safeguarding Trust and Avoiding Penalties

In the finance enterprise, in which client believe, regulatory scrutiny, and facts sensitivity intersect, advertising compliance is not only a great practice—it’s a necessity. Financial institutions, along with banks, coverage companies, fintech startups, and investment organizations, must navigate a complex web of neighborhood and worldwide policies to ensure their promotional techniques are transparent, moral, and legally sound.

Regulators inclusive of the SEC, FINRA, FCA, and RBI intently screen economic advertising to shield customers from deceptive or deceptive claims. This manner that each one advertising substances—whether digital advertisements, social media posts, emails, or website content material—need to be correct, balanced, and supported through information. Any exaggeration of blessings, omission of risks, or ambiguous wording can result in fines, reputational harm, and criminal consequences.

Compliance additionally involves strict information protection measures, in particular when campaigns rely on patron records for personalization. With regulations like GDPR and CCPA in place, marketers ought to secure explicit consent, make sure statistics accuracy, and provide smooth opt-out mechanisms. Furthermore, preserving a steady file of approvals, content adjustments, and disclosures is vital in audits or legal reviews.

In this high-stakes environment, marketing compliance empowers corporations to construct lasting consider, demonstrate accountability, and foster lengthy-term consumer relationships. By aligning creativity with law, economic marketers not best keep away from penalties but also differentiate their emblem in an industry wherein credibility is forex.

What Is Marketing Compliance?

Marketing compliance refers to the adherence of promotional content material, advertising campaigns, and marketing techniques to all relevant laws, rules, enterprise standards, and internal company rules. In the financial quarter, marketing compliance is in particular vital, as this enterprise is concern to intense scrutiny because of the sensitive nature of financial services and products and their capacity effect on customers.

Financial establishments ought to ensure that each one advertising materials — consisting of brochures, social media posts, emails, websites, and commercials — are accurate, clear, fair, and now not deceptive. These substances must now not overstate potential returns or understate related dangers. Additionally, they have to include essential disclosures and disclaimers, specifically when marketing investment merchandise or credit offerings.

Regulatory our bodies liable for imposing those requirements vary by way of place. In the US, as an instance, the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), and Consumer Financial Protection Bureau (CFPB) play most important roles. In the United Kingdom, it is the Financial Conduct Authority (FCA). In different components of the arena, similar roles are performed through respective countrywide monetary regulatory organizations.

Beyond legal adherence, organizations also put into effect internal compliance opinions and approval workflows to make sure emblem consistency and regulatory alignment. This now not only minimizes legal threat but additionally builds believe with customers, defensive logo reputation and patron relationships over the long term.

Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) is the important financial institution of India, chargeable for regulating the usa’s economic and economic system. Established on April 1, 1935, below the Reserve Bank of India Act, 1934, it turned into initially a non-public entity however was nationalized in 1949, making it thoroughly owned by way of the Government of India.

Headquartered in Mumbai, the RBI serves as the custodian of the united states of america’s monetary stability. Its number one features encompass issuing forex, regulating the deliver of money, managing inflation, and appearing as a banker to the authorities. It additionally supervises and regulates the functioning of commercial banks, non-banking financial organizations (NBFCs), and cooperative banks, ensuring the stability of the economic system.

The RBI formulates financial coverage through units just like the repo rate, reverse repo rate, cash reserve ratio (CRR), and statutory liquidity ratio (SLR). These gear help control inflation and make sure ok liquidity inside the economic system. It additionally manages the Foreign Exchange Management Act (FEMA) and regulates foreign exchange markets to stabilize the Indian rupee.

Another key function of the RBI is to sell monetary inclusion and improve virtual price infrastructure thru projects like UPI, Bharat BillPay, and Rupay. It has also installed bodies just like the Banking Ombudsman to deal with customer grievances.

The RBI is ruled with the aid of a central board of administrators appointed by using the Government of India, headed via the Governor, presently Shaktikanta Das (as of 2025).

In summary, the RBI is the backbone of India’s monetary architecture, making sure economic increase, charge stability, and public self assurance inside the financial gadget.

Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) is the main regulatory authority for securities markets in India. It became established on April 12, 1988, and turned into given statutory powers thru the SEBI Act, 1992. Headquartered in Mumbai, SEBI’s number one position is to guard the interests of traders, adjust the securities marketplace, and promote its development.

SEBI regulates inventory exchanges, brokers, sub-agents, mutual finances, portfolio managers, funding advisers, and different marketplace intermediaries. It enforces recommendations to make certain transparency, truthful buying and selling practices, and prevention of fraud in securities markets. SEBI is also answerable for registering and regulating IPOs, making sure that listed organizations observe proper disclosure norms, and coping with investor grievances.

SEBI has quasi-legislative, quasi-govt, and quasi-judicial powers. It can draft regulations, behavior investigations, and impose penalties on violators. Some key projects with the aid of SEBI consist of selling electronic buying and selling, strengthening corporate governance norms, and facilitating investor schooling thru economic literacy packages.

In latest years, SEBI has played a important position in modernizing and stabilizing India’s economic markets, improving investor self belief, and making Indian capital markets more obvious and on hand to worldwide buyers.

Insurance Regulatory and Development Authority of India (IRDAI)

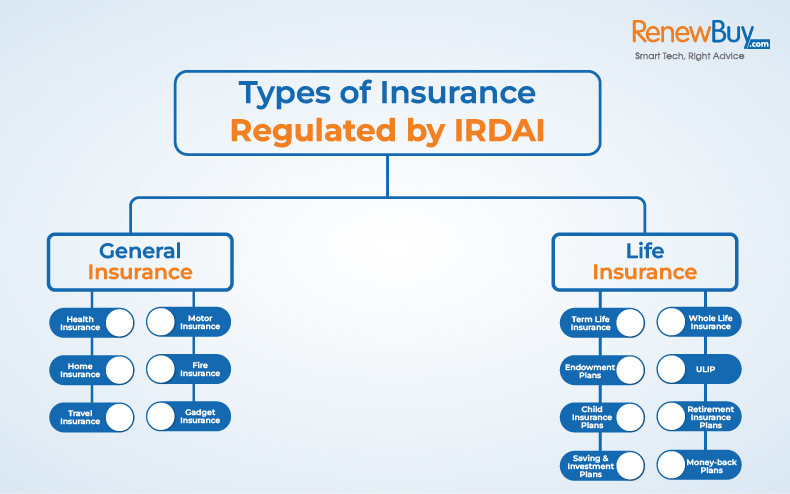

The Insurance Regulatory and Development Authority of India (IRDAI) is the apex body accountable for regulating and developing the coverage enterprise in India. It was hooked up in 1999 beneath the IRDA Act, 1999 and is situated in Hyderabad, Telangana. The number one goal of IRDAI is to guard the hobbies of policyholders, make sure the economic soundness of the coverage sector, and promote honest competition.

IRDAI regulates each life and standard coverage organizations. It offers licenses to coverage agencies and intermediaries like marketers and agents. It formulates suggestions to make certain transparency, financial prudence, and purchaser safety. The authority also oversees product approval, solvency margins, funding norms, and claims settlement approaches. Through these measures, IRDAI guarantees that insurers are capable of meeting their duties to policyholders.

A key feature of IRDAI is to encourage the growth of the coverage region whilst making sure that policyholders are dealt with pretty. It promotes financial inclusion through supporting the unfold of coverage in rural regions and among economically weaker sections of society. IRDAI also regulates premium costs for positive regulations and guarantees that insurers hold adequate reserves.

IRDAI performs a crucial position in developing new guidelines, implementing virtual improvements like e-coverage, and enhancing patron criticism redressal structures. It monitors and regulates the reinsurance marketplace as nicely. By maintaining a stability between growth and regulation, IRDAI contributes to building a robust and reliable insurance atmosphere in India.

The Advertising Standards Council of India (ASCI)

The Advertising Standards Council of India (ASCI) is a voluntary self-regulatory organisation installed in 1985 to maintain and beautify the public’s self assurance in marketing. It became shaped by way of enterprise stakeholders inclusive of advertisers, marketing corporations, media, and different allied our bodies. ASCI’s primary goal is to make sure that commercials are sincere, felony, decent, and no longer offensive or misleading, accordingly protective purchaser interest and promoting truthful opposition.

ASCI’s operations are guided with the aid of its Code for Self-Regulation in Advertising (ASCI Code). This code sets requirements for the content material of advertisements and covers four foremost regions: truthfulness and honesty, non-offensiveness to public decency, protection, and fairness in opposition. The ASCI Code applies to all media platforms including print, tv, radio, digital, and social media.

One of the key capabilities of ASCI is to address purchaser complaints regarding deceptive or unethical advertisements. It has a Consumer Complaints Council (CCC), an independent body that critiques and adjudicates complaints. If an advert is discovered to violate the code, ASCI requests the advertiser to withdraw or modify it. Though ASCI does no longer have legal enforcement electricity, its decisions are respected due to enterprise consensus and help from authorities our bodies like the Ministry of Information and Broadcasting.

In the digital technology, ASCI has come to be more proactive in monitoring on line content material, in particular influencer advertising. Its Guidelines for Influencer Advertising on Digital Media make sure transparency in paid promotions. By promoting ethical marketing, ASCI performs a vital role in constructing believe between brands and customers in India’s dynamic marketing landscape.

General Data Protection Regulations (GDPR)

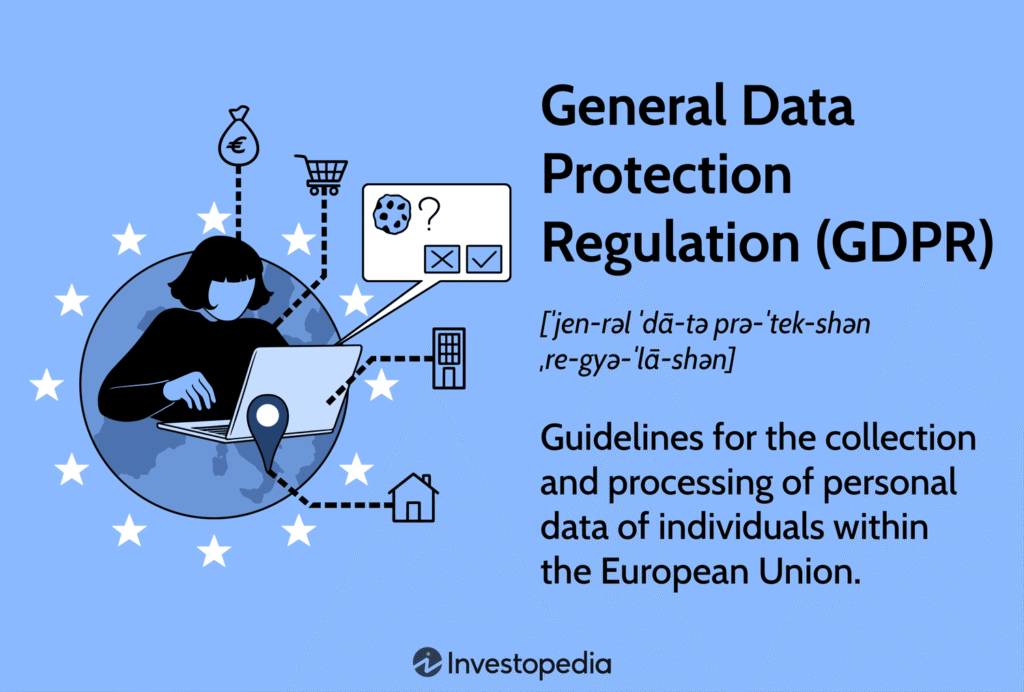

The General Data Protection Regulation (GDPR) is a complete statistics safety law enacted by using the European Union (EU) that came into impact on May 25, 2018. It was designed to harmonize statistics privateness legal guidelines across Europe, protect the privateness rights of EU citizens, and reshape the way agencies throughout the location handle non-public statistics.

GDPR applies to any organization that collects, stores, or tactics the non-public statistics of EU residents, irrespective of in which the corporation is based totally. Personal records includes any facts associated with an identifiable man or woman, inclusive of names, email addresses, region information, and more. The regulation offers individuals extra manage over their personal facts and imposes strict necessities on companies to ensure statistics is processed lawfully, transparently, and securely.

Under GDPR, people have numerous key rights, including the proper to get entry to their data, the right to accurate inaccuracies, the proper to erasure (also referred to as the “proper to be forgotten”), the right to facts portability, and the proper to item to sure kinds of records processing. Organizations must also gain clear and affirmative consent before collecting information and are required to document statistics breaches within seventy two hours.

Failure to comply with GDPR can result in widespread fines—up to €20 million or 4% of worldwide annual turnover, whichever is better. As such, the law has forced organizations to check and enhance their statistics safety practices, put into effect robust cybersecurity measures, and appoint Data Protection Officers (DPOs) wherein required.

GDPR has set a international general for privacy and information protection, influencing similar legal guidelines in international locations like Brazil, India, and the US. It underscores the growing importance of protecting non-public statistics within.

Why Is It Important?

Regulatory Penalties: Non-Compliance Can Result in Hefty Fines, License Revocation, or Legal Actions

In these days’s tightly ruled enterprise environment, regulatory compliance isn’t always simply a first-rate practice—it is a criminal requirement. Companies that fail to adhere to local, national, or global guidelines face considerable results. Non-compliance can cause severe economic penalties, suspension or revocation of licenses, reputational damage, or even crook legal responsibility for key individuals.

Regulatory our bodies which include the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Food Safety and Standards Authority of India (FSSAI), and others closely screen compliance throughout industries. Failure to comply with their tips can result in hefty fines jogging into lakhs or even crores of rupees. For instance, financial institutions breaching RBI norms can be fined and prohibited from sure operations, while meals manufacturers failing FSSAI requirements may additionally have their licenses suspended, halting all manufacturing and income.

Beyond financial penalties, regulatory corporations can initiate prison motion, main to courtroom proceedings, asset seizures, and imprisonment in extreme instances. Such actions now not only disrupt business operations however additionally harm public believe and investor confidence. In sectors like healthcare, finance, and infrastructure, compliance lapses can cause irreparable harm.

To avoid these risks, businesses need to enforce robust compliance applications, behavior regular audits, teach personnel, and live up to date on regulatory modifications. Proactive compliance is an investment in long-term sustainability and trust.

Reputation Management: The High Cost of Misleading Advertising

In trendy virtual age, a organisation’s reputation is considered one of its maximum valuable assets. Consumers have extra access to statistics than ever earlier than, and their perceptions can be influenced in an instantaneous—specifically via advertising. Misleading commercials, even if unintentional, can reason lasting harm to a brand’s credibility and trustworthiness.

Customers anticipate honesty and transparency. When an ad overpromises or misrepresents a services or products, it now not simplest fails to meet expectancies but additionally triggers a feel of betrayal. This results in terrible opinions, public backlash, and viral social media criticism. Once consumer consider is misplaced, it turns into extremely tough and steeply-priced to regain.

Furthermore, regulatory our bodies together with the Advertising Standards Council of India (ASCI) or the Federal Trade Commission (FTC) within the U.S. Actively monitor advertising practices. Violations can cause criminal motion, fines, and public notices—in addition tarnishing a organisation’s photograph. Competitors might also take benefit of such slip-u.S.To reinforce their own logo belief.

Effective reputation control starts with moral advertising. Brands need to make sure their advertising is honest, clear, and backed with the aid of real fee. Monitoring client remarks, rapidly addressing lawsuits, and preserving open communication channels are also important for sustaining goodwill.

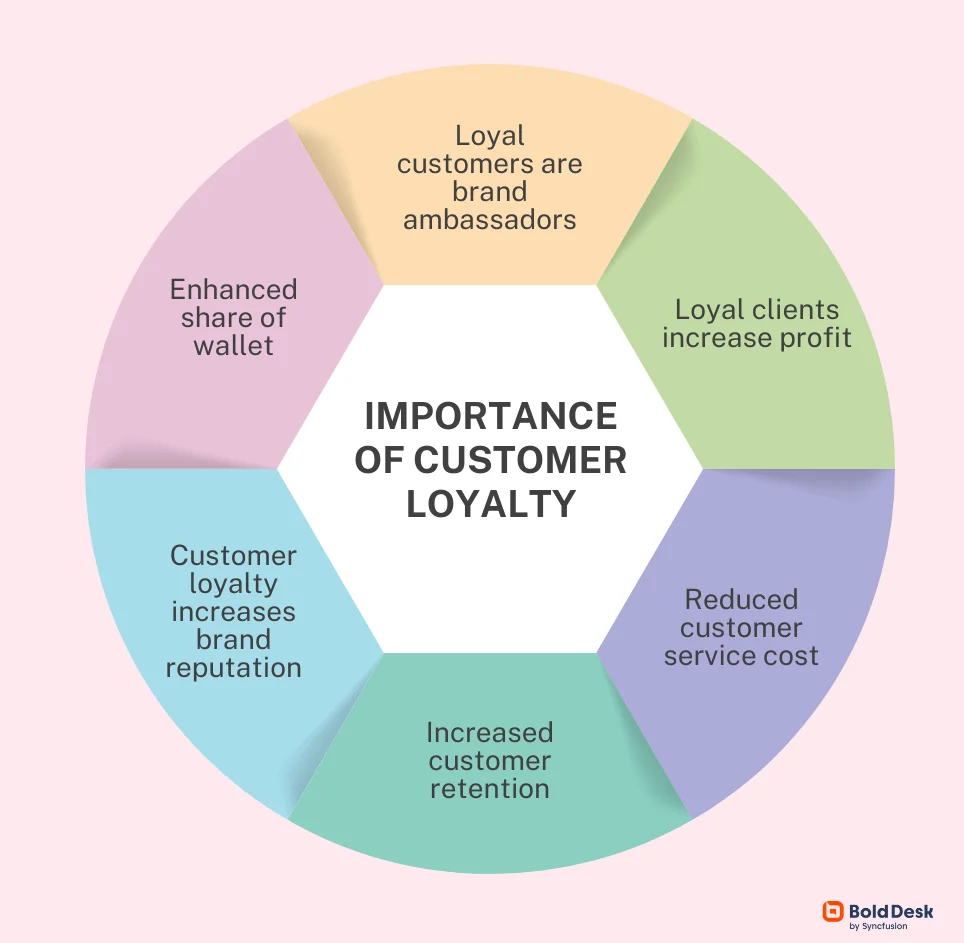

In end, deceptive commercials might generate short-term gains, but the long-term damage to recognition and client loyalty is hardly ever well worth the hazard. A logo constructed on consider will continually outperform one built on deception.

Customer Protection: The Role of Transparent Marketing in Financial Services

Transparent advertising plays a critical function in safeguarding purchaser pursuits, particularly within the economic offerings sector where accept as true with and clarity are paramount. By ensuring that all communique regarding financial products is obvious, sincere, and complete, companies empower clients to make informed choices, thereby promoting lengthy-time period trust and stability in the marketplace.

One of the middle factors of customer safety is the prevention of deceptive commercials. Transparent advertising guarantees that product features, related dangers, hobby prices, expenses, and other terms and situations are truly communicated to searching for what you offer. This allows reduce confusion and prevents consumers from being misled into selecting improper or high-hazard merchandise. For example, disclosing the variable nature of returns in an investment product facilitates set practical expectancies and decreases potential dissatisfaction later.

Moreover, obvious advertising includes the usage of simple, jargon-free language, making sure that even first-time investors or financially less-literate individuals can understand the important thing elements of a product. It additionally promotes using assessment gear and risk signs that permit customers to evaluate special merchandise fairly.

Regulatory our bodies consisting of SEBI, RBI, and IRDAI in India have emphasised the importance of transparency via mandating disclosures and honest marketing practices. Institutions that prioritize transparency are much more likely to construct robust, lasting relationships with customers, keep away from prison pitfalls, and gain a aggressive edge via superior credibility and goodwill.

In conclusion, transparent advertising isn’t always only a first-rate practice but a fundamental pillar of custom

Data Privacy: A Crucial Element in Marketing Campaigns

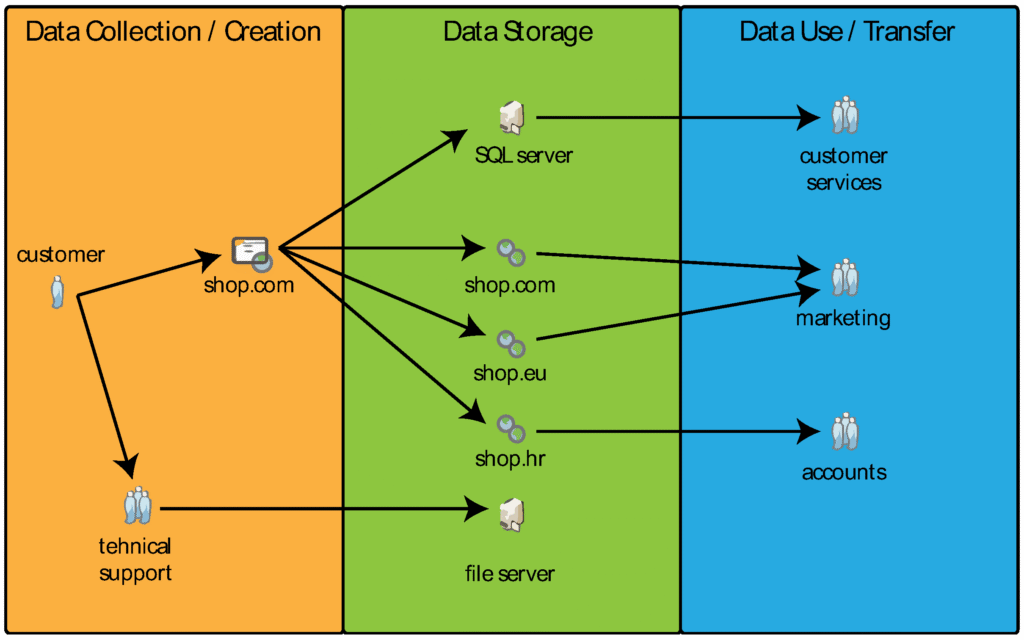

In these days’s digital age, advertising and marketing techniques increasingly depend upon accumulating and reading customer information to deliver personalised and targeted studies. However, with this energy comes remarkable obligation. Organizations ought to strictly follow records privacy and protection laws together with the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and India’s Digital Personal Data Protection Act (DPDPA) to protect consumer believe and keep away from severe criminal and monetary repercussions.

Marketing campaigns regularly contain accumulating touchy personal information inclusive of names, e-mail addresses, alternatives, area records, and online behavior. This records, when used ethically, can decorate consumer engagement and conversion charges. Yet, failure to control this information securely or transparently can cause records breaches, unauthorized sharing, identification robbery, and proceedings.

Companies are legally required to gain knowledgeable consent before collecting private records, ensure information is used for valid purposes, and provide customers with rights to get admission to, correct, or delete their records. Transparency is important — customers ought to actually understand what information is being accumulated and the way it’ll be used.

Moreover, entrepreneurs should collaborate with IT and criminal teams to put in force records encryption, stable storage, and get entry to controls. Regular audits and compliance checks ought to be integrated into marketing campaign workflows.

Respecting statistics privateness is not just a prison duty — it’s far a strategic gain. Brands that prioritize consumer privacy foster trust, loyalty, and lengthy-term fulfillment in an increasingly privacy-aware global.

Common Areas of Marketing Risk in Finance

Misleading Claims: Exaggerating Benefits of Loans, Insurance, or Investment Returns

In these days’s quite competitive financial marketplace, agencies frequently resort to exaggerated or deceptive claims to attract customers. This is especially obvious in the promotion of loans, insurance regulations, and funding schemes. Advertisements or promotional substances may additionally highlight most effective the appealing elements—which include “zero-interest,” “assured returns,” or “lifetime insurance”—at the same time as hiding vital terms and conditions in best print. This form of misrepresentation can lead to great financial damage for customers who are lured via guarantees that seem too exact to be genuine.

Loan carriers can also put it on the market extremely low hobby costs without clarifying that these charges are relevant best below specific situations or for a quick introductory duration. The actual fees, consisting of hidden costs and processing expenses, often continue to be undisclosed till after the patron is dedicated. Similarly, coverage companies would possibly emphasize excessive coverage or assured advantages with out properly disclosing exclusions, ready intervals, or premium hikes. Investment advisors may additionally sell schemes with “assured” high returns, neglecting to say the risks worried or beyond performance statistics.

Such misleading advertising practices erode consumer trust and violate moral standards. Regulatory our bodies have began taking motion, however purchasers ought to also exercise warning—cautiously studying all phrases, asking questions, and in search of expert advice when important. Transparent conversation, now not exaggeration, ought to be the muse of all monetary services.

Incomplete Disclosures: Hiding or Downplaying Risk Factors, Fees, or Lock-in Periods

Incomplete disclosures in financial services and investment products occur when critical information—such as risk factors, hidden fees, or mandatory lock-in periods—is concealed, misrepresented, or downplayed. This deceptive practice can mislead investors and consumers into making decisions they might otherwise avoid if fully informed.

Financial advisors, brokers, or companies may highlight only the potential returns while minimizing or failing to disclose risks like market volatility, credit risk, liquidity challenges, or regulatory uncertainty. Similarly, upfront or recurring fees—management charges, processing costs, early withdrawal penalties—are sometimes obscured in fine print or not disclosed at all during initial discussions. Lock-in periods, which restrict access to funds for a defined duration, are particularly impactful. When these are not transparently communicated, investors may find themselves unable to liquidate assets when needed, leading to financial strain.

Such practices breach the principle of informed consent and violate trust between provider and client. Regulatory bodies like SEBI, RBI, and IRDAI mandate full transparency and fair disclosure to protect retail investors. Failure to comply can result in penalties, reputational loss, or even legal action.

Ultimately, incomplete disclosures not only harm individual investors but also erode confidence in the broader financial ecosystem. Ethical selling requires full transparency—ensuring clients are aware of both benefits and drawbacks before committing their money.

“Improper Use of Customer Data: Violating Consent Norms or Using Sensitive Data for Targeted Ads Without Clear Permission”:

In today’s data-driven economy, customer information is a powerful asset. However, its misuse—especially without proper consent—poses serious ethical and legal risks. Improper use of customer data occurs when businesses collect, process, or share personal or sensitive data without the user’s informed and explicit consent. A common violation involves using such data for targeted advertising, where companies deploy algorithms to display personalized ads based on browsing history, location, purchase behavior, or even private communications—often without the user realizing how deeply their privacy is being invaded.

This practice breaches data protection laws such as the GDPR in Europe or India’s proposed Digital Personal Data Protection Act. These laws emphasize transparency, user control, and the necessity of obtaining unambiguous permission before data usage. Ignoring these regulations not only leads to legal consequences but also erodes customer trust. When users feel manipulated or exploited, brand loyalty diminishes and reputational damage becomes inevitable.

Additionally, the unauthorized use of sensitive data—such as health records, religious beliefs, or financial details—can lead to discrimination or exploitation, especially when used to profile or exclude users unfairly. Responsible data handling means being transparent about data collection, giving users the right to opt in or out, and using data strictly for the purpose consented to. Ethical data practices are not just about compliance—they are about respecting the digital rights and dignity of individuals.

Use of Influencers: Employing Social Media Influencers Without Disclaimers or Transparency About Sponsorships

The use of social media influencers has become a effective marketing approach for manufacturers looking for to build agree with and authenticity. However, employing influencers with out clean disclaimers or transparency approximately sponsorships increases critical ethical and prison concerns. When influencers promote services or products without disclosing paid partnerships, fans are misled into believing the endorsements are actual and impartial. This lack of transparency erodes patron consider and may bring about lengthy-term reputational damage for both the influencer and the logo.

From a regulatory perspective, many jurisdictions, which include the U.S. Federal Trade Commission (FTC), require influencers to reveal paid promotions truely and conspicuously. Failure to conform can cause legal consequences and public backlash. Transparency is crucial to maintaining honesty in advertising and shielding consumers from deceptive advertising practices.

Moreover, undisclosed sponsorships make the most the private relationship among influencers and their target market. Followers may additionally make purchasing decisions based totally on perceived authenticity, unaware that the content material is financially motivated. This no longer best undermines patron autonomy but also diminishes the integrity of digital content material creation.

Brands should make certain that every one influencer partnerships are disclosed with suitable hashtags such as #ad or #sponsored and encourage influencers to be open about their affiliations. Transparent influencer advertising and marketing fosters credibility, builds stronger relationships with purchasers, and upholds moral standards in the virtual marketplace.

Cross-Border Promotions: Risks of Ignoring Local Compliance

Expanding advertising and marketing campaigns into foreign markets can free up enormous growth opportunities. However, failing to understand local compliance guidelines can result in critical prison, monetary, and reputational effects. Many organizations rush into move-border promotions with a one-size-suits-all method, overlooking u . S .-unique laws round advertising, client protection, statistics privacy, and digital content.

For instance, a marketing campaign that complies with U.S. FTC rules might violate the EU’s GDPR if it mishandles non-public facts. Similarly, promotional contests or giveaways may require government approval in a few countries or have precise tax implications for winners. Language usage, cultural sensitivities, and prohibited content material (e.G., in alcohol, healthcare, or economic sectors) additionally vary widely via place.

Ignorance isn’t an excuse within the eyes of regulators. Non-compliance can result in fines, marketing campaign shutdowns, or bans from advertising systems. Worse, it may damage brand recognition and purchaser believe overseas. To keep away from those pitfalls, manufacturers should conduct thorough felony critiques, localize their content, and work with nearby compliance professionals earlier than launching.

Ultimately, successful global advertising demands extra than translation—it calls for cultural and criminal version. Understanding the compliance landscape of each goal market is not elective; it’s a strategic necessity.

Best Practices for Marketing Compliance

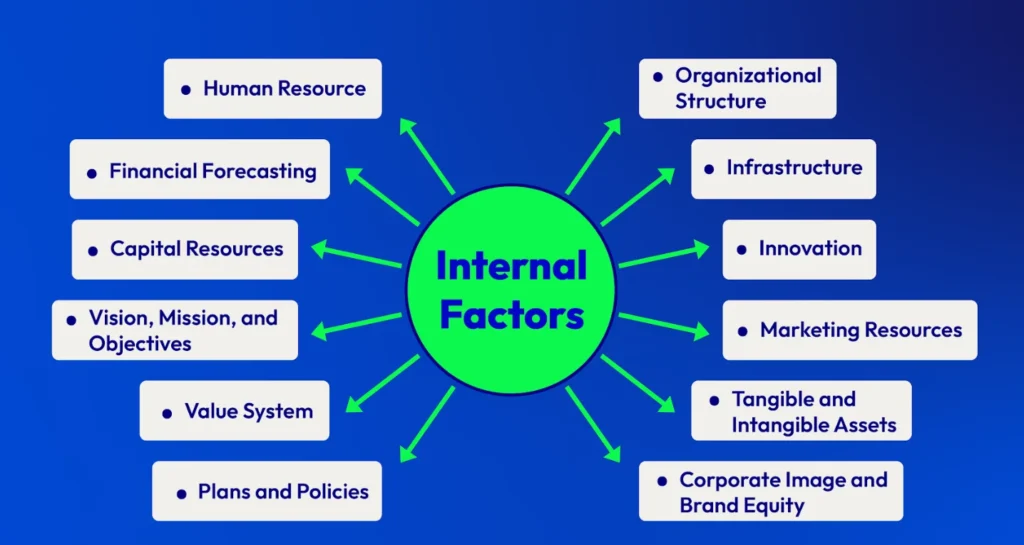

Legal and compliance review: Protection of your brand and prestige

In today’s rapidly developed digital and regulatory scenario, it is not just to ensure legal and proper compliance in all marketing material – this is necessary. From traditional brochures and hamstring to dynamic digital ads, e -post campaigns and social media, all marketing benefits should go through legal and compliance reviews.

This process helps to identify possible risks related to non-transport with industry-specific rules such as false ads, fractures of intellectual property, data contradictions and GDPR, Can-spam or FTC guidelines. A single unseen claims or incorrect Bayani can cause serious legal consequences, including fines, prosecutors, recognized damage or loss of consumer confidence.

Legal teams play an important role in this animal process. They ensure that all campaign languages are true, reinforced and properly rejected. In addition, they verify that the necessary licenses, the endorsement and permits are secured, especially when third -party property (eg images, admirers or music) is used.

In addition, the match review process continuously provides a framework for the branding. From the beginning, by integrating legal reviews into the marketing of workflows, companies can reduce expensive rebirth, avoid delays and maintain adaptation with both internal guidelines and external rules.

In short, an active legal and compliance process is not a barrier – this is a strategic security. This allows the abolition to perform bold, creative campaigns, ensure integrity, ensure integrity, ensure integrity and perform bold, creative campaigns.

Revelations and Disclaimers: Ensure openness to trust and compliance

In order to create a trust and fulfill regulatory standards, companies must provide clear, visual disclosure and disconnection on risks, fees and conditions related to their products or services. Openness is not just a legal requirement-it is a basis for credibility and long-term customer relationships.

Disclaimer should be short, prominent and easy to understand. Avoid fine pressure or buried information. Where necessary, use bold text, excursion box or model pop. Make sure all major customers appear to be waived at touch points before registration, under transactions and in marketing materials.

For example, if a product carries an economic risk or variable return, the state is clear: “The previous performance does not guarantee future consequences. All investment risk, including possible capital losses.” Similarly, if your service includes recurrent fees or renewal fees, the state will: “This is a member service. You will not be canceled.

The terms and conditions must be available and right by using regular language on legal jargon. Highlight important segments such as cancellation rules, corresponding to qualifying or renewal cycle. Once implemented, include a summary or FAQ for better user understanding.

In digital interfaces, users use check routes or confirmation to actively accept the conditions before continuing. This practice helps protect both the customer and your business by preventing disputes and improving openness.

Gradually, the moral use of revelations and disconnects reflects professionalism and the user’s respect.

Customer Consent Management: Obtain and Store Proof of Opt-ins for Promotional Communications

Customer Consent Management is a essential thing of any compliant and ethical advertising approach. It involves obtaining express permission from clients earlier than sending them promotional communications through e-mail, SMS, or other virtual channels. Consent must be freely given, precise, knowledgeable, and unambiguous, ensuring that individuals fully apprehend what they’re subscribing to.

To maintain compliance with facts protection policies which include GDPR, CAN-SPAM, and India’s DPDP Act, organizations ought to establish systems that in reality file and securely shop evidence of every patron’s decide-in. This includes taking pictures the approach of consent (e.G., website checkbox, form submission), timestamp, IP deal with, and the precise content material of the consent announcement proven on the time of opt-in. This records serves as criminal evidence in case of disputes or audits.

Automated Consent Management Platforms (CMPs) or Customer Relationship Management (CRM) equipment included with advertising automation can streamline this system by way of logging opt-in occasions and storing them in an encrypted, auditable layout. Customers have to additionally be provided with a clear and easy way to update their possibilities or withdraw consent at any time.

Transparent consent practices now not simplest defend organizations legally but additionally foster patron agree with. By ensuring that communications are best sent to people who’ve agreed to get hold of them, corporations can enhance engagement quotes, lessen spam lawsuits, and construct more potent, extra respectful patron relationships.

Staff Training: Equip Your Marketing and Sales Teams with Training on Compliance Rules and Ethical Advertising

In today’s fast-paced business environment, ensuring that your marketing and sales teams are well-versed in compliance regulations and ethical advertising practices is not just advisable—it’s essential. With growing scrutiny from regulators, increased consumer awareness, and the rapid dissemination of information via digital platforms, one misstep can lead to reputational damage, legal consequences, and loss of customer trust.

Effective staff training programs should include comprehensive sessions on industry-specific regulations such as data privacy laws (e.g., GDPR or local equivalents), advertising standards, and guidelines from consumer protection authorities. Sales and marketing professionals must understand what constitutes misleading or deceptive advertising, how to handle customer data responsibly, and the importance of clear, honest communication in campaigns.

Training should also emphasize ethical considerations such as fairness, transparency, and inclusivity in messaging. Role-playing scenarios, case studies, and interactive workshops can help team members apply these principles in real-world situations.

Regular refresher courses and updates are crucial to stay aligned with evolving laws and best practices. Investing in this kind of training not only safeguards your organization but also empowers your staff to act with integrity—boosting consumer confidence and building long-term brand loyalty.

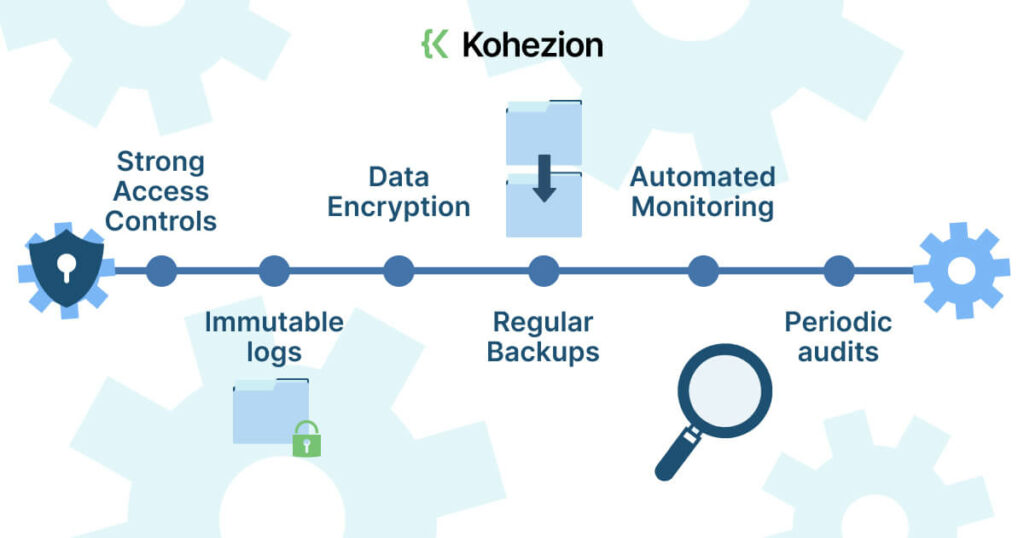

Audit Trails in Digital Marketing Compliance

An audit trail refers to a detailed, chronological record of all actions, changes, and approvals related to marketing campaigns. In the realm of digital marketing, maintaining a reliable audit trail is essential for accountability, transparency, and regulatory compliance. Audit trails serve as the backbone for internal reviews and external audits, helping to demonstrate that campaigns have adhered to legal, ethical, and brand guidelines.

Campaign Approvals:

A proper audit trail should begin with documenting the approval process. Every campaign—whether it’s an email blast, social media post, or ad copy—must go through an internal review involving multiple stakeholders, such as legal, compliance, and marketing heads. Each stage of approval, including the date, approver’s name, and any comments or conditions, should be recorded.

Content Versions:

Content often goes through several iterations before it’s finalized. Tracking each version, including timestamps and editors involved, ensures clarity on how and why specific changes were made. This is crucial in regulated industries like finance, healthcare, or pharmaceuticals, where one misleading claim can lead to legal penalties.

Performance Data:

Performance metrics like impressions, CTR, conversions, and engagement rates also need to be logged as part of the audit trail. This not only helps in optimizing future campaigns but also provides a complete picture for compliance reviews, showing how campaigns were measured and refined.

Maintaining comprehensive audit trails mitigates risk, facilitates accountability, and ensures organizations are always prepared for audits and compliance inquiries.

Technology & Tools for Compliance

Modern martech solutions provide a powerful suite of features that assist businesses streamline their advertising and marketing efforts, enhance targeting, and pressure better ROI. One of the middle functions of these platforms is data integration, enabling marketers to gather and unify purchaser facts from various sources together with websites, social media, CRMs, and advert systems. This holistic view of client behavior allows for more personalized and efficient campaigns.

Another important characteristic is automation. Martech tools automate repetitive duties like e mail advertising, social media posting, lead nurturing, or even advert bidding, releasing up time and resources. Artificial Intelligence (AI) and device gaining knowledge of further enhance those tools by means of optimizing marketing campaign overall performance, predicting patron conduct, and delivering smart suggestions.

Customer segmentation is also a key functionality, helping marketers target particular agencies with tailor-made messaging. Martech answers frequently consist of content management structures (CMS), A/B trying out, actual-time analytics, and consumer journey mapping, permitting teams to test techniques and make data-driven decisions quick.

Cross-channel advertising is another highlight, letting businesses run included campaigns throughout structures like email, SMS, push notifications, and social media from a single dashboard. Finally, current martech guarantees compliance with records privacy laws like GDPR and CCPA, safeguarding each brand reputation and patron agree with.

In essence, martech empowers corporations to connect, interact, and convert possibilities extra efficiently in an more and more virtual and aggressive landscape.

Automated Compliance Checks for Ad Content

Automated compliance checks for ad content are critical in modern day virtual marketing landscape, where brands run more than one advert campaigns throughout structures with strict and ranging rules. These checks use artificial intelligence (AI) and machine studying (ML) technologies to make certain that marketing content material complies with enterprise standards, platform policies (e.G., Google, Facebook), and neighborhood legal regulations earlier than they go live.

These systems examine ad reproduction, creatives, touchdown pages, keywords, or even focused on parameters. They flag non-compliant elements like deceptive claims, prohibited content material (e.G., person or limited health-associated products), lacking disclaimers, or irrelevant language. By detecting issues early, businesses keep away from ad rejections, account bans, or criminal dangers.

The automation allows for scalable advert evaluate, in particular beneficial for organizations or brands coping with excessive ad volumes. It additionally reduces guide workload and hastens the approval manner. Some advanced equipment integrate without delay with advert platforms and CMS structures to provide actual-time comments all through content material introduction.

In regulated industries like finance, healthcare, or prison offerings, computerized compliance tools are invaluable. They can be configured to comply with particular hints and industry codes, making sure consistent adherence with out relying totally on human review.

Ultimately, automated compliance assessments improve advert first-rate, construct accept as true with with platforms and audiences, and assist corporations operate ethically and effectively within digital marketing environments.

Centralized material management system with approval work flow:

Centralized material management systems (CMS) with approved workflows are important tools for modern organizations seeking stability, control and collaboration in digital material operations. These platforms centralize all material assets lessons, images, videos, documents- in a single depot, make it easy to manage, update and distribute information in many channels and teams.

Approval increases control by defining a structured path for construction, editing, reviewing and publishing the workflow. Usually, Workflow offers specific roles – such as content creators, editors, approvals and publishers – sensors are reviewed for accuracy, branding and compliance before the sensor. This not only reduces errors, but also helps maintain quality and regulatory standards.

Operations for companies with multiple departments or in regulated industries, centralized CMS platforms strengthened operations and completed the repetition of the experiment. Team members reach the same source of truth, preventing incorrect communication and deviations. Facilities such as version control, activity log and permission settings present transparency and accountability.

In fast-facing digital environments, approval can speed up treatment time when preserving CM control with workflow. This enables real -time cooperation and ensures that unauthorized or uncontrolled material does not reach the audience. Overall, such systems are important for managing digital assets with reliability and strategic inspection.

Audit Logs for Every Campaign Step

Audit logs are a vital aspect in retaining transparency, accountability, and manipulate during the entire lifecycle of a advertising marketing campaign. With specified audit trails at each campaign step—whether or not it’s developing, modifying, scheduling, launching, or pausing a marketing campaign—you advantage full visibility into what moves had been taken, after they took place, and who carried out them. This facilitates make sure compliance with inner techniques and enterprise rules, in particular in environments in which strict governance is required.

Our platform logs every trade made throughout all ranges of a campaign. From minor replica edits to major budget modifications, every motion is recorded with a timestamp and consumer credentials. This ancient report empowers managers to monitor overall performance, hint again decisions, and clear up disputes effectively.

In collaborative advertising and marketing environments, audit logs offer peace of mind by way of removing guesswork. Team individuals can without problems evaluate updates, detect unauthorized changes, and repair previous configurations if needed. Audit logs also resource in put up-campaign evaluations by means of displaying how every modification impacted the very last outcome.

Whether you’re optimizing ad creatives, updating concentrated on parameters, or changing marketing campaign status, relaxation confident that each flow is tracked and securely saved. These logs are handy in real time, exportable for compliance audits, and backed by means of organisation-grade statistics retention policies. Trust, transparency, and operational readability—introduced through certain audit logs at each step.

AI-primarily based tracking of live virtual commercials is reworking the way advertisers and regulators hit upon policy violations, fraud, and content mismatches in actual time. Leveraging gadget learning algorithms and computer vision, those systems can automatically experiment heaps of stay commercials throughout a couple of platforms—such as Google, Facebook, YouTube, and programmatic networks—within seconds. AI models examine visual, textual, and contextual components of every advert, evaluating them in opposition to predefined compliance standards, community guidelines, or legal frameworks.

For instance, AI can immediately flag beside the point language, copyright violations, misleading claims, or unapproved medical or economic references. Natural language processing (NLP) identifies false or manipulative statements, at the same time as photo popularity detects limited symbols or visual elements. Some systems even tune user engagement metrics and behavioral alerts to perceive bot-generated visitors or click on fraud, providing a proactive reaction earlier than ad budgets are wasted.

Another primary advantage is scalability—AI equipment can display hundreds of thousands of impressions simultaneously, some thing guide teams should in no way gain. This now not most effective reduces the hazard of emblem protection troubles but also ensures adherence to neighborhood marketing laws throughout exclusive geographies. Alerts may be configured to notify human reviewers instantly, allowing rapid takedowns or edits.

Real-time AI advert monitoring is turning into essential in industries like prescription drugs, finance, politics, and gaming—in which missteps can result in legal effects or public backlash. By integrating AI-pushed compliance tests into stay advert campaigns, companies can guard their popularity, make sure consumer consider, and optimize ad performance through continuous, automatic over